En los últimos días, los mercados han observado cómo el precio de Bitcoin (BTC) alcanzaba nuevos máximos históricos, superando los 70.000 dólares. Sin embargo, una lectura más detallada de la actividad en la cadena de bloques revela un panorama sorprendentemente diferente.

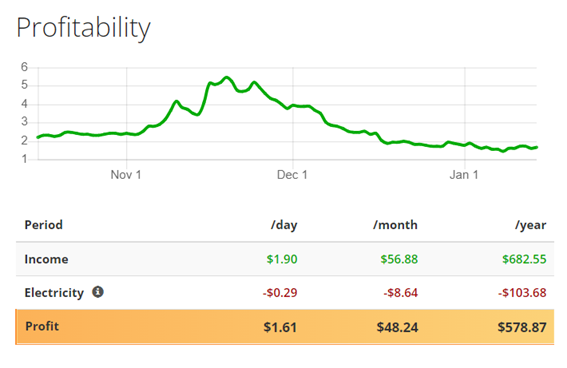

Según los datos rastreados por Glassnode, el valor en dólares de las transferencias medias en la cadena de bloques de Bitcoin se mantiene significativamente por debajo del pico alcanzado en 2021. Esta discrepancia entre el precio en alza y la actividad económica en la cadena refleja en parte un fuerte sentimiento de retención en el mercado, según señala una empresa de investigación.

Los analistas de Blockware Solutions, en su último boletín Blockware Intelligence, señalan: “El volumen medio de transferencias en la cadena (en dólares) está muy por debajo del máximo del mercado alcista de 2021. Apenas se está moviendo valor en la cadena. Nadie quiere vender”.

La métrica de Glassnode considera el valor en dólares estadounidenses del total de BTC transferidos en la cadena, solo contabilizando las transferencias realizadas con éxito. Al momento de cerrar esta edición, el volumen medio de transferencias de siete y 14 días se situaba por debajo de los 200.000 dólares, en marcado contraste con el millón de dólares y más durante el mercado alcista de 2021.

La reciente aprobación de los ETF de Bitcoin al contado por parte de Wall Street, cotizando en el Nasdaq, ha sido señalada como la principal razón detrás del último repunte de Bitcoin. Esto ha resultado en una concentración del volumen al contado en los ETF, lo que también explica el bajo volumen en la cadena de bloques.

No obstante, otros indicadores sugieren que los inversores que sobrevivieron al mercado bajista de 2022 están conservando sus reservas de monedas anticipando un aumento continuado en los precios. Por ejemplo, el porcentaje de la oferta de bitcoins que estuvo activa por última vez hace entre tres y cinco años sigue en aumento.

Varios analistas proyectan que el precio de Bitcoin podría superar las seis cifras en los próximos meses, llegando incluso a superar los 150.000 dólares. Los analistas de Blockware agregan: “Cuando veamos que el precio empieza a moverse de verdad, se disparará el volumen en la cadena. Las monedas más antiguas se venderán en los exchanges. Hasta entonces, el bajo volumen en la cadena es un signo de iliquidez por el lado de la oferta”.